Welcome

Since 1995 thousands of Australian's have trusted us to obtain their finance

We can instantly compare thousands of loans from 70+ lenders to find the most suitable and cheapest options for your requirements

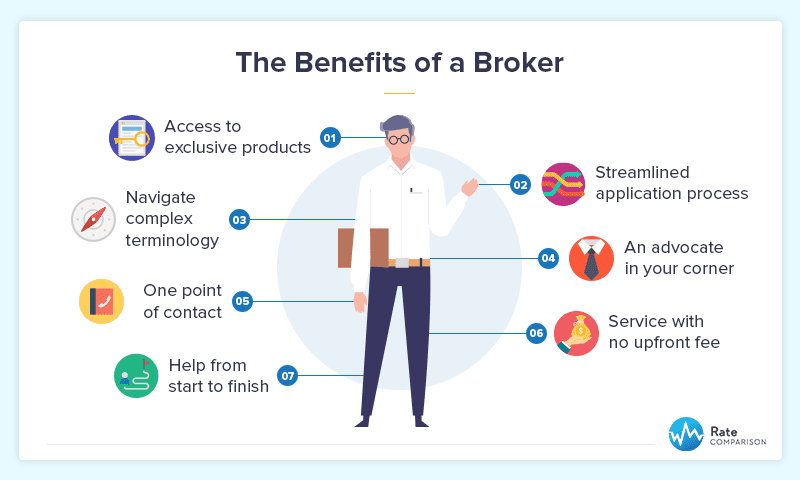

We take pride in our ability to simplify the whole process and deliver competitive solutions tailored to your individual needs

Making finance easy is what we do!

Got 30 secs ...?

Have a listen to how we work for you

Why Us?

We make personal and business finance simple, clear and tailored to you

listen to your needs and present competitive options from our wide panel of lenders, including all the major banks

Once you are happy and ready to proceed, we'll take care of everything and keep you informed every step of the way

Here's what our clients say about us

Ready to get started?

Choose an option below or start a chat with us

We’re always happy to help